INSTITUTE INDEX - The reality behind Romney's tax moocher claims

Date on which Mother Jones magazine released a video of Republican

presidential candidate Mitt Romney telling wealthy donors that "47 percent" of

U.S. voters "pay no income tax," are "dependent upon government," and "will vote

for the president no matter what": 9/17/2012

Date on which Mother Jones magazine released a video of Republican

presidential candidate Mitt Romney telling wealthy donors that "47 percent" of

U.S. voters "pay no income tax," are "dependent upon government," and "will vote

for the president no matter what": 9/17/2012Percent of U.S. households that paid no federal income tax in 2011: 46.4

Portion of those households that paid no federal income tax because they had no taxable income after the standard deduction and personal exemptions: 1/2

Portion that paid no federal income tax because they got enough tax breaks to wipe out their basic tax liability: 1/2

Of those households that paid no income tax, portion that still paid payroll taxes, which fund Social Security and Medicare: nearly 2/3

Percent of U.S. households that paid neither income taxes nor payroll taxes: 18.1

Portion of those people who paid neither income nor payroll taxes who are elderly: over 1/2

Portion of those who paid neither income nor payroll taxes who are not elderly but have income under $20,000: over 1/3

Year in which Congress first created the earned income tax credit (EITC), a key anti-poverty tool that's a major reason many Americans don't pay income taxes: 1975

Year in which Republican President Reagan expanded that credit, which was originally championed by Democratic Sen. Russell Long of Louisiana, son of the legendary populist Louisiana Gov. and Sen. Huey Long: 1986

Percent of the 38 million U.S. households that don't pay income tax due to targeted tax breaks for which the EITC is responsible: about 30

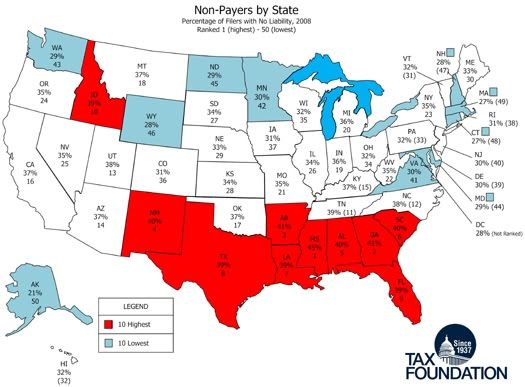

Of the 10 states with the lowest percentage of filers who don't pay income taxes (blue states in map above), number in the South: 1*

Of the 10 states with the highest percentage of filers who don't pay income taxes (red states in map above), number in the South: 9**

At this point in the presidential race, number of electoral college votes Romney is expected to get from the "moocher states": 95

Number of electoral college votes President Obama is expected to get from those states: 5

* Virginia, along with Alaska, Connecticut, Maryland, Massachusetts, Minnesota, New Hampshire, North Dakota, Washington and Wyoming

** Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, South Carolina and Texas, along with Idaho and New Mexico

(Click on figure to go to source. To comment on or share this index, click here. Map from the Tax Foundation; click on image for a larger version)

http://www.southernstudies.org/2012/09/institute-index-the-reality-behind-romneys-tax-moocher-claims.html

No comments:

Post a Comment