|

‘It Makes a Hell of a Lot More Sense to Negotiate Sharing Technology, Rather Than Locking It Down’ - CounterSpin interview with Dean Baker on Trump's trade war

view post on FAIR.org

Janine Jackson interviewed Dean Baker about Trump’s trade war with China for the May 24, 2019, episode of CounterSpin. This is a lightly edited transcript.

MP3 Link

Janine Jackson: To be generous to journalists, Donald Trump has introduced a new dimension to policy-making. In assessing his current trade war with China, for example, reporters are forced to consider: Does Trump believe, as he says, that tariffs imposed on Chinese goods are paid by the Chinese? Does he not know how tariffs work? Is he pretending not to know? Does it not matter, because he just wants to be seen to be “clashing with Beijing”? Which of these possibilities are China and other countries responding to? And will Fox air a show on Chinese checkers next week, and all of this changes? It’s not clear.

But the murk around the White House’s thinking is all the more reason for reporters to be as clear as possible in explaining the actual impacts on differently situated people of economic actions. Joining us now to help with that is Dean Baker, senior economist and co-founder of the Center for Economic and Policy Research, and author of the book Rigged, among other titles. He joins us now by phone from Utah. Welcome back to CounterSpin, Dean Baker.

Dean Baker: Thanks a lot for having me on.

JJ: Just over a week ago now, Trump tweeted:

Tariffs are NOW being paid to the United States by China of 25% on 250 Billion Dollars worth of goods & products. These massive payments go directly to the Treasury of the U.S.

Why or how is that statement untrue?

DB: I think he’s very confused, or at least what that statement indicates, he’s very confused about who’s paying the tariff. The tariff’s a tax. So let’s just say it’s a tax, a tax on imports from China.

So most immediately, who pays the tax on imports from China? Well, US consumers are paying it.

And to just make an analogy, when I lived Washington, DC, they put a five-cent tax on plastic bags. So if you’re going to the grocery store and you want a plastic bag, they put a five-cent tax on it. Who paid that? Well, if you’re the person getting the bag, you paid the five-cent tax. Now, you can make an argument, some of that may end up being absorbed by the grocery store, maybe they cut their prices a tiny bit, so I only end up paying four cents a bag, that’s entirely possible. But most immediately, I’m paying that five-cent tax.

And same story here with imports from China. We have a 25 percent tariff. It’s the people who buy shoes that are made in China, clothes that are made in China, toys, all the other things we get from China—the people who buy those products are going to be paying that 25 percent tax.

JJ: Media have acknowledged that tariffs don’t work in the way that Trump is saying they do. But that’s not meaning, necessarily, that they’re saying that they’re bad policy. The New York Times had an editorial in which they said:

Mr. Trump could make an honest case for this tax increase. He could argue that Americans must endure higher prices, because China will suffer too…. [And that is because] there is widespread agreement, both in the United States and among America’s allies, that China is engaged in unfair practices, such as state-subsidized manufacturing, theft of intellectual property, and both formal and informal constraints on foreign businesses.

So the Times and others are saying, China has been engaged in these unfair practices, and tariffs are a tool to get them to change their behavior.

DB: Well, they use an overblown analogy. I mean, they use the term “trade war.” So let’s make an analogy to actual war.

If you fight a war, people are going to die. That’s bad, everyone should be able to agree on that. On the other hand, if we’re fighting the Civil War, and we want to end slavery, well, that could be worth that; if we’re fighting World War II and stop the Holocaust, that could be worth that.

So there’s no doubt, tariffs are imposing a cost on US consumers, on the US economy. And that’s a negative. But if it’s for some positive end, at the end of the day, that we could hope to gain, then that could be a good thing.

Now, what I’ve taken issue with here is, originally Trump was focused on manufacturing products; he went around the country yelling China’s a “currency manipulator.” I’m not very fond of that term; but China was deliberately keeping down the value of its currency, and that gave it an advantage in trade. So if its currency is 20 percent lower, relative to the dollar, that in effect makes its goods 20 percent cheaper for people in the United States, makes our goods 20 percent more expensive for people in China. So we import more from them. And we export less to them. He had a legitimate point there.

But currency has largely disappeared from his agenda. And what has seemed to be front and center is this idea of intellectual property. And this takes two basic forms. One is that, the argument goes, they don’t respect our patents and copyrights, and make copies of products that US companies have patent and copyright claims on, and they don’t compensate them for that.

The other is that when a company like Boeing or GE comes to China, they’re required to get a domestic partner, domestic Chinese partner, and, in effect, share their technology with them. So that company then becomes a competitor, three, four or five years down the road, when they’ve mastered the technology.

So this has become front and center in Trump’s trade war. And what I’d argue is, there’s a legitimate issue for workers here, that we could have more manufacturing jobs if we got them to raise the value of their currency, say, by 20 percent; it’s an arbitrary number, but say they raise the value of their currency by 20 percent. I don’t mean next week, I mean over three years or whatever.

JJ: Right.

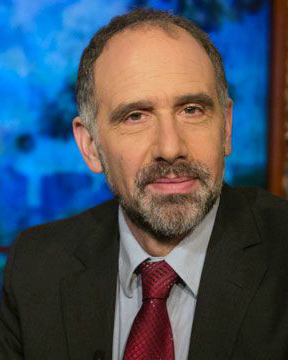

Dean Baker: “The ‘trade war’ seems to be about arguing points that would actually increase the profits of US companies, and do nothing, and possibly even be a negative, for workers in the United States.” (image: BillMoyers.com)

DB: That would mean more jobs for manufacturing workers in the US. When it comes to the question, are they respecting Microsoft‘s intellectual property, or Pfizer’s intellectual property, and their drugs? That’s not for workers in the US, that’s for Microsoft’s profits, that’s for Pfizer’s profits.

When there’s an issue of Boeing and General Electric being unhappy that, when they open up shop in China, they have to share their technology with the Chinese firm that’s going to be a competitor, that’s Boeing and GE’s profits.

And furthermore, if we win that battle, and they say, “OK, Boeing and GE no longer have to do that,” we’re encouraging outsourcing, they’ll be more likely to outsource to China. That’s not an issue that US workers have a stake in.

So there are legitimate complaints against China, which Trump actually mentioned endlessly during his campaign. Those seem to have gone off the table. And instead, the “trade war” seems to be about arguing points that would actually increase the profits of US companies, and do nothing, and possibly even be a negative, for workers in the United States.

JJ: Well, and that’s why this big, unchallenged frame of China versus America is so uselessly crude, because, of course, we know that that’s not exactly the way lines are drawn, and people are differently situated within each of those nations.

It’s been interesting to see fissures showing in unexpected places. You have Lou Dobbs telling Trump to “ignore all the Wall Street firms,” and Corey Lewandowski is talking about the Chamber of Commerce as the “chamber of horrors.” And then other fissures are being papered over, as when, for example, this CBS and AP explainer says that the cost of import taxes is falling on US “consumers and businesses,” as though me and, as you’re just saying, Boeing, you know…. “Consumers and businesses,” and then workers, are being all lumped together, as though they were identically situated and impacted in just the same way. It seems like in some ways, media are drawing lines where it’s not most illustrative of what’s really going on.

DB: Yeah, well, they try to make it sound, I don’t know how many times I’ve seen this written, I’ve made fun of it in my blog a number of times, where they talk about “our” intellectual property. Well, China’s never taken any of my intellectual property. And I suspect most people in the country can make the same statement. So it’s not ours, it’s Boeing’s intellectual property, it’s Microsoft’s intellectual property. And those are arguable points.

I mean, I understand that, if you have companies in the US that are spending all this money on technology, and China just gets it for free, that is an issue. But that’s a very, very different issue than saying that you and I somehow have had something stolen because Microsoft takes a loss on not getting their patents and copyrights respected in China.

I’ve also made the point, this is kind of remarkable to me, we should actually be interested in getting technology from China—just simple arithmetic here. China’s economy is already 25 percent larger than ours, and most projections show it being twice the size of the US economy in less than a decade. They spend roughly the same share of their GDP on research and development as we do.

And you just go, OK, well, people in China aren’t stupid, as best I could tell; if they’re spending more on research and development than we are, then there’s probably more technology they’re developing that we should want than technology we’re developing that they would want. So rather than focusing on locking down Boeing and GE’s technology, we should be focused on how we can make sure we have access to China’s technology.

And just to give a very specific example, China has as much solar and wind capacity as the rest of the world combined. This year, they can produce as many electric cars as the rest of the world combined. They have a lot of good technology in clean technology, clean energy use, that we should want access to. And that’s probably more important than making sure that Boeing doesn’t have to get a domestic partner in China who’s going to master its technology.

JJ: When you describe it that way, you can think of a world in which countries are engaged with one another, but when you read just the language of this media coverage: Trump isn’t going to “flinch.” The Chinese are “looking for weakness.” We’re reading about Trump’s refusal to “soften,” all of this bellicose imagery. Even the New York Times editorial , Trump should have sold tariffs by saying, well, it’ll hurt Americans, but it’s OK because “China will suffer, too.”

This idea of nations as natural enemies or rivals, whether it’s a hot war or an economic war, this kind of zero-sum vision of global interaction starts to feel so outmoded. It feels like a cartoonish way of looking at the way that countries interconnect; there has to be a different economic vision of the way that countries can exist together.

DB: Well, the irony of this is that these were all the people who were talking about trade being a win/win. So they’ve just flipped over 180 degrees. And particularly, it does get down in a very important way to this question of intellectual property, where they’re concerned to lock it down, patents and copyrights. And, to my view, this is absolutely nuts. I mean, patents and copyrights, God didn’t give them to us. These are relics of the medieval guild system, which, you know, we could argue whether that was a good system back then, or even 100 or 200 years ago. Maybe it was, maybe it wasn’t; it’s not a good system in the 21st century with a globalized economy. We should be thinking about how we could share technology, and certainly share the cost. So we should have some international agreements where we’re going to spend a certain share of our GDP, China will, the European countries….

People say, “Well, that’s really hard to negotiate.” And I like to point out: Guess what, guys, it wasn’t easy for you to negotiate patent and copyright issues in your trade deals. In fact, the Trans-Pacific Partnership, Obama would have had that finished and approved by Congress before the end of his term, if they hadn’t been fighting over drug patent issues right to the end. So, yes, it’s not going to be easy to negotiate something like that. But what we have now surely isn’t easy to negotiate. And it makes a hell of a lot more sense to negotiate something that aims toward sharing technology, rather than locking it down, as our current system does.

JJ: We’ve been speaking with Dean Baker of the Center for Economic and Policy Research, online at cepr.net. His article, “Trump’s Trade War With China Is Waged to Make the Rich Richer,” can be found there, as well as on Truthout.org. Dean Baker, thank you so much for joining us this week on CounterSpin.

DB: Thanks a lot for having me on.

|

|

No comments:

Post a Comment