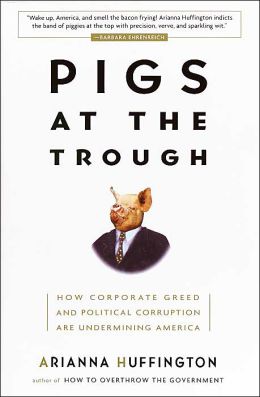

So much for Republicans eliminating pork!

| ||||

Gluttonous Farm Bill

Volume XVIII No. 48: November 27, 2013

Thanksgiving is a day to pause and give

thanks. Yet when it comes to agriculture, lobbyists and farm state lawmakers

just can’t seem to get enough. While they should take Thanksgiving to think

about just how great they have it, they’re actually bickering over who gets the

next big helping of taxpayer subsidies.

The agriculture sector has a lot to be

thankful for. As the USDA just reported, net farm income for 2013 is

set to be a record $131 billion. That’s 15% more than last year and, after

adjusting for inflation, the best year since 1973. Yet the appetite of industry

lobbyists and farm state lawmakers is unquenchable. Now attempts to negotiate a

compromise farm bill have broken down as each individual lobby pushes for a

greater piece of the taxpayer dollar pie.

Covering everything from loan guarantees for

biofuels facilities and grants for drinking water wells to food assistance and

crop insurance, the farm bill is a nearly $1 trillion buffet of

special interest dishes. And it’s a spread that routinely costs more than

expected – the last two farm bills are on pace to cost $400 billion more than

was estimated when they were adopted. With our nation now $17 trillion in debt

and after receiving a directive to find budget savings, the agriculture

committees are being forced to change their ways. But treating the bill as

something other than a bird to stuff with parochial giveaways is proving hard

for them to stomach.

One of the richest parts of the farm bill is

the federally subsidized crop insurance entitlement

program. Producers of everything from almonds to oysters receive taxpayer

subsidies to buy insurance, not just on their crops, but usually on the revenue

they expect from those crops. It’s extremely (overly) generous, on average more

than 60% of the premium is covered by taxpayers, and the program cost $14

billion last year – in a year with the best profits in more than a generation!

But the agriculture committees aren’t looking to enact common sense reforms to crop insurance, but

instead to expand the program and actually increase spending.

For the last two years they’ve attempted to add every dish they can onto the crop insurance gravy train. The centerpiece turkey is taken care of with mandates for “business interruption” insurance for poultry producers who experience losses due to slaughterhouse bankruptcies or “catastrophic events,” aka the weather. Not into poultry—you’re covered! Producers of your holiday ham could get their own insurance for disease outbreaks, there’s profit margin insurance for catfish producers, and even a directive for USDA to study policies for seafood harvesters. Yes, seafood crop insurance. One can only guess we’ll pay the difference if boatmen are looking for jumbo shrimp but only net medium ones.

But it’s not just the meat getting attention.

There’s a mandate to create peanut revenue insurance. The House gives priority

to rice. The Senate expands this to cover all specialty crops, USDA speak for

basically everything you’d recognize as a fruit or vegetable. There’s also a

focus on sugar cane, sweet sorghum, and other “dedicated energy crops.” Even the

tablecloth is covered, as cotton gets its own elite program added on top of crop insurance. And

no worries if you leave those leftovers out too long and they begin to spoil,

there’s priority consideration in developing a crop insurance policy to cover

losses due to “health advisory, removal, or recall related to a contamination

concern.”

Taxpayers can’t afford for the agriculture

committees to continue to write farm bills that, as House Agriculture Committee Chairman Lucas (R-OK)

said himself, "get us through bad times and make the good times better.” Reforming crop insurance so that it’s part of a

cost-effective, accountable, transparent, and responsive agriculture safety net

is possible. But lawmakers will have to first stop the mad scramble to load up

their platters with parochial giveaways and reflect on just how great they

already have it. There’s no better day to do that than

Thanksgiving.

Quote of the Week

"Have you ever wondered why farmers are not asking for a farm bill? They do not need one. Their crops will grow without one."

-Minnesota farmer Harlan R. Anderson in the Minneapolis Star Tribune

No comments:

Post a Comment