Paul Begala offered his insight below, as well as the amusing FAUX propaganda.

At the bottom, there's some information about the 8 of the top 10 states that receive the most federal welfare are Republican.

When you perpetuate ignorance and poor public education, it's easy to ignore the simple facts.

My prediction is that this represents the self-destruction of the Republican Party from within, too ignorant to recognize that they got us where we are and too blinded to retreat. Pity!

A Pox on One of Their Houses

The crisis isn’t both parties’ fault.

In a column on the budget, to maintain credibility with Beltway elites, I am supposed to claim the impasse is both parties’ fault. It isn’t. The conventional wisdom is that Republicans won’t support any more tax increases and Democrats won’t support any more spending cuts. That’s half right.

House Democrats have proposed some sensible spending cuts: like doing away with the billions we spend subsidizing oil companies. With gas nearing $4 a gallon, does anyone really want to send taxpayers’ money to the welfare queens of ExxonMobil? House Dems would also enact the Buffett rule (I prefer “Romney rule”), ending the obscenity in the tax code that lets hedge-fund managers pay a lower tax rate than their secretaries.

Not to be outdone, Senate Democrats have proposed $110 billion in spending cuts and tax increases: again, reducing oil subsidies (though not as much as the House Dems), ending the deduction businesses take for moving jobs overseas and trimming the defense budget and farm subsidies.

Finally, the White House boasts of having eliminated 77 government programs, including 16 at the Department of Education, 10 at Health and Human Services, and 4 at Labor. The president’s budget calls for $30 billion in cuts to farm programs and $25 billion in savings from the post office.

The Republicans, for their part, did allow the Bush tax cuts to expire on income over $450,000, but they seem to have dug in their heels on the Romney rule and oil subsidies. They are blaming President Obama’s “failed leadership” for the sequester and arguing that it was the White House that first proposed the gun-to-the-head approach. As the kids say, whatevs. The Democrats have come to the table with spending cuts. Will the Republicans join them and support some tax increases? Um, no.

“Just last month,” House Speaker John Boehner said, “The president got his higher taxes on the wealthy, and he’s already back for more.” True. But there is still some very low-hanging fruit on the revenue side. Republicans ought to at least embrace the Romney rule—if for no other reason than to punish Mitt for running such a lame campaign.

Don't worry about the government's latest fiscal crisis; the right wing punditocracy argued all week that it's all a political sideshow.

Meanwhile, some congressional Republicans are taking a break from complaining about government spending to complain about the lack of government spending. As Politico has reported, Mississippi Republican Sen. Roger Wicker is worried about cuts to the Army Corps of Engineers, Maine Republican Sen. Susan Collins is fretting over potential job losses at the Portsmouth Naval Shipyard, and John McCain has continued his longstanding opposition to a sequester, bringing it home by telling his fellow Arizonans, “They make the Apache helicopter in Mesa, Arizona. If they cut back, it would have to be affected there.”

I would take it further. The new Tea Party senator from Texas, Ted Cruz, says, “I think we have to be prepared to go so far as to shut the government down if we don’t get some serious policies to stop the out-of-control spending to tackle the debt.” OK, let’s start by shutting down federal spending in Texas. Federal funds account for 32 percent of the Lone Star State’s budget. Oh, and how about Fort Hood? At 340 square miles, it is the biggest Army base in the free world and the largest single employer in Texas. All that federal spending must be sapping the souls of my fellow Texans. So let’s move Fort Hood to, oh, say, Nevada. Sen. Harry Reid actually believes in federal investments, and the Nevada desert might provide good terrain for Fort Hood’s tanks.

This could be fun. Oklahoma so hates Obama’s big spending that every single county in the state voted for Mitt Romney. Oklahoma has twice the percentage of federal employees than the U.S. average, and Okies get $1.35 back from Washington for each dollar they pay in taxes. So close the massive FAA center in Oklahoma City. Move it to Nancy Pelosi’s San Francisco district, where they love big government.

Two years ago I made a similar argument about Kentucky, calling on Republican Sens. Mitch McConnell and Rand Paul to put the Bluegrass State in detox for its addiction to local pork. No such luck. But perhaps the principle can apply to the sequester: enforce it only in states whose elected representatives won’t support the taxes needed to fund the spending they want.

http://www.thedailybeast.com/newsweek/2013/02/25/begala-the-great-sequester-lie.html

Blue State, Red Face: Guess Who Benefits More From Your Taxes?

|

Posted Thursday, Oct. 25, 2012

The results will stun many people, though not me: I’ve been telling my Tea Party relatives this for years. Here’s a list of the top 10 states that got the most back in terms of federal benefits, followed by the bottom 10. I’ve added the reasons why, when they’re obvious, in the space to the right.

To save space below, “pension benefits” include both Medicare and Social Security; “anti-poverty aid” includes Head Start, Low Income Home Energy Assistance, Food Stamp and nutrition programs for Women, Infants and Children (WIC), and several school-lunch-style benefits.

Top Ten (Source: Tax Foundation):

1. New Mexico Indian reservations, military bases, federal research labs, farm subsidies, retirement programs

2. Mississippi Farm subsidies, military spending, nutrition and anti-poverty aid, retirement programs.

3. Alaska Per capita No 1 recipient of federal benefits; infrastructure projects, DOT and pork projects.

4. Louisiana Disaster relief, farm subsidies, anti-poverty and nutrition aid, military spending.

5. W. Virginia Farm subsidies, anti-poverty and nutrition aid.

6. N. Dakota Farm subsidies, energy subsidies, retirement and anti-poverty programs, Indian reservations.

7. Alabama Retirement programs, anti-poverty and nutrition aid, federal space/military spending, farm subsidies.

8. S. Dakota Retirement programs, nutrition aid, farm subsidies, military spending, Indian reservations.

9. Virginia Civil service pensions, military spending, veterans benefits, retirement, anti-poverty aid.

10. Kentucky Retirement programs, nutritional and anti-poverty aid, farm subsidies.

Now consider the bottom 10, i.e., the ones that give more to the federal government in taxes than they get in return. From 1 to 10, they are:

New Jersey, Nevada, Connecticut, New Hampshire, Minnesota, Illinois, Delaware, California, New York, Colorado.

Anything strange about that list? Yes, they are all blue states (or the deepest of purple).

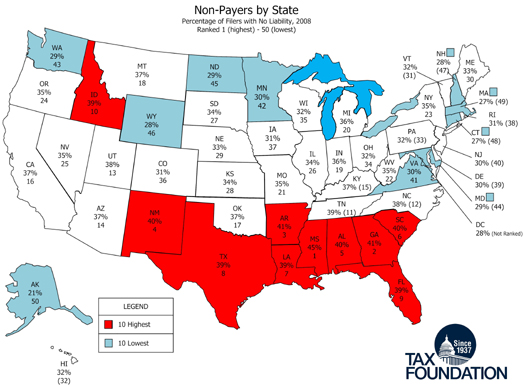

Adding to this fallacy are the assumptions surrounding Mitt Romney’s now infamous comments about the indolent “47 percent” of Americans who regard themselves as victims and therefore pay no taxes. As the American Conservative magazine (no less) pointed out recently, nine of those 10 states are in the red-as-ruby Old Confederacy.*

Put another way, again by the American Conservative, “On the other hand, eight of the ten states with the highest non-payment rates are solidly Republican. The exceptions are New Mexico and Florida.”

Is your mouth agape?

Now, one more cross-reference: these facts compared with the know-nothing rhetoric of the Tea Party. There are only two ways to parse that result: one is ignorance—which we should be willing to forgive in anyone as long as they revise their views when faced with reality.

And the second? Selfish hypocrisy. How else can you explain the fact that the denizens of the most welfare dependent states in the country—dare we say, those who enjoy the most benefits from socialism—profess to abhor welfare?

This is a far cry from what most people think. My sense is that, if you asked the average American, they would assume that states benefiting most from federal spending are exactly the opposite—you know, those populated with Ronald Reagan’s “welfare queens” and lazy unionized auto workers.

I’ll be the first to admit this isn’t a black-and-white exercise. Plenty of questions need to be settled before clear judgments can be made. For instance, does an Army base and the federal money that goes into keeping it running and paying its troops count as a benefit? (It does in my book.) What about a federal prison? (Yeah, jobs and the tax revenues they generate should count there, too.) A private university that is showered with federal research dollars? (Again, yes, those funds count, too.)

But those questions get harder.

Agricultural subsidies? How do we count them—and do we subtract the tax revenues generated by the jobs the farm creates or the export earnings it provides?

And what about defense contractors? Connecticut, Washington state, and California are chock full of weapons merchants. They provide jobs, export income, and many other benefits. Should we count as a federal inflow to those states the money spent, say, on Sikorsky aircraft contracts in Connecticut?

And how do we factor in the taxes those companies paid (assuming, unlike nearby General Electric, they actually paid taxes)?

And I admit, maybe we should dock Connecticut and New Jersey for the remaining outstanding balance of the TARP program?

All these accounting issues are over my head, I’ll freely admit. But I trust the figures above, compiled by the rock solid economists at the Tax Foundation, a nonpartisan research group—as a good indicator of the general state of our fiscal reality. When the reality has veered so far from the prevailing political bullshit, it’s time for someone to point it out.

So spare me all that red state angst about the federal deficits and national debt. When you stop spending New Jersey’s money, Tex, and produce a plan to replace it with your own revenue stream, then you've earned an opinion in the matter.

Corrections, Oct. 25, 2012: This blog post originally cited the Tax Institute for its data; the data were provided by the Tax Foundation. It also referred to the "blue-as-cobalt Old Confederacy." Those states are typically identified as red states.

http://www.slate.com/blogs/the_reckoning/2012/10/25/blue_state_red_face_guess_who_benefits_more_from_your_taxes.html

The Economist has a chart ranking each state ---

No comments:

Post a Comment